Understanding Whole Life Insurance Quotes & Illustrations

FREE Life Insurance Quotes

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insur...

Farmers CSR for 4 Years

UPDATED: Mar 26, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

Chances are you’ve just finished doing your homework by reviewing our current list of the best whole life insurance companies. You’ve chosen one or more products that seem right for you. Congratulations!

The next step is getting the actual whole life insurance quotes and understanding exactly how the coverage works. This will all be explained within the quote or otherwise known as the illustration.

Sometimes, insurance quotes can seem complicated and overwhelming.

Don’t worry. We’re here to help you understand what those quotes mean in practical terms so you can make a good decision.

Ready for the mystery to be removed from whole life insurance quotes? Here we go!

Looking to compare life insurance policies? We can help. Enter your ZIP code to get free quotes from multiple insurers.

Whole Life Insurance Quotes Include an Illustration

All whole life insurance quotes come with something called an illustration. The illustration provides a great deal of information pertaining to how the whole life insurance policy will perform, the benefits included with the coverage as well as potential future performances.

Sometimes, the way illustrations are presented can make them seem a bit dull, a bit long and bit complex, but they are extremely important because they allow you to assess the entire whole life insurance quote on more than the cost of premiums.

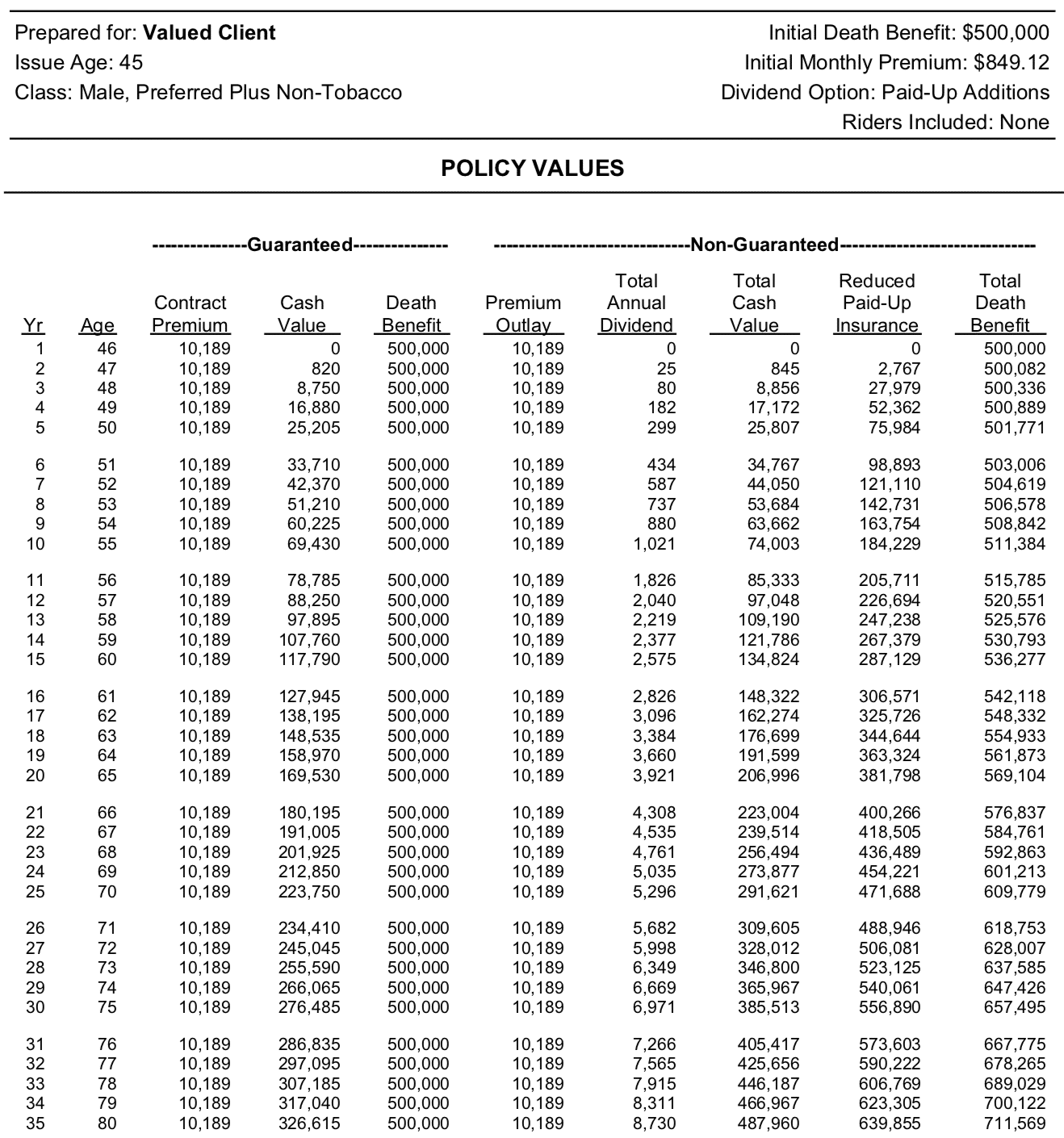

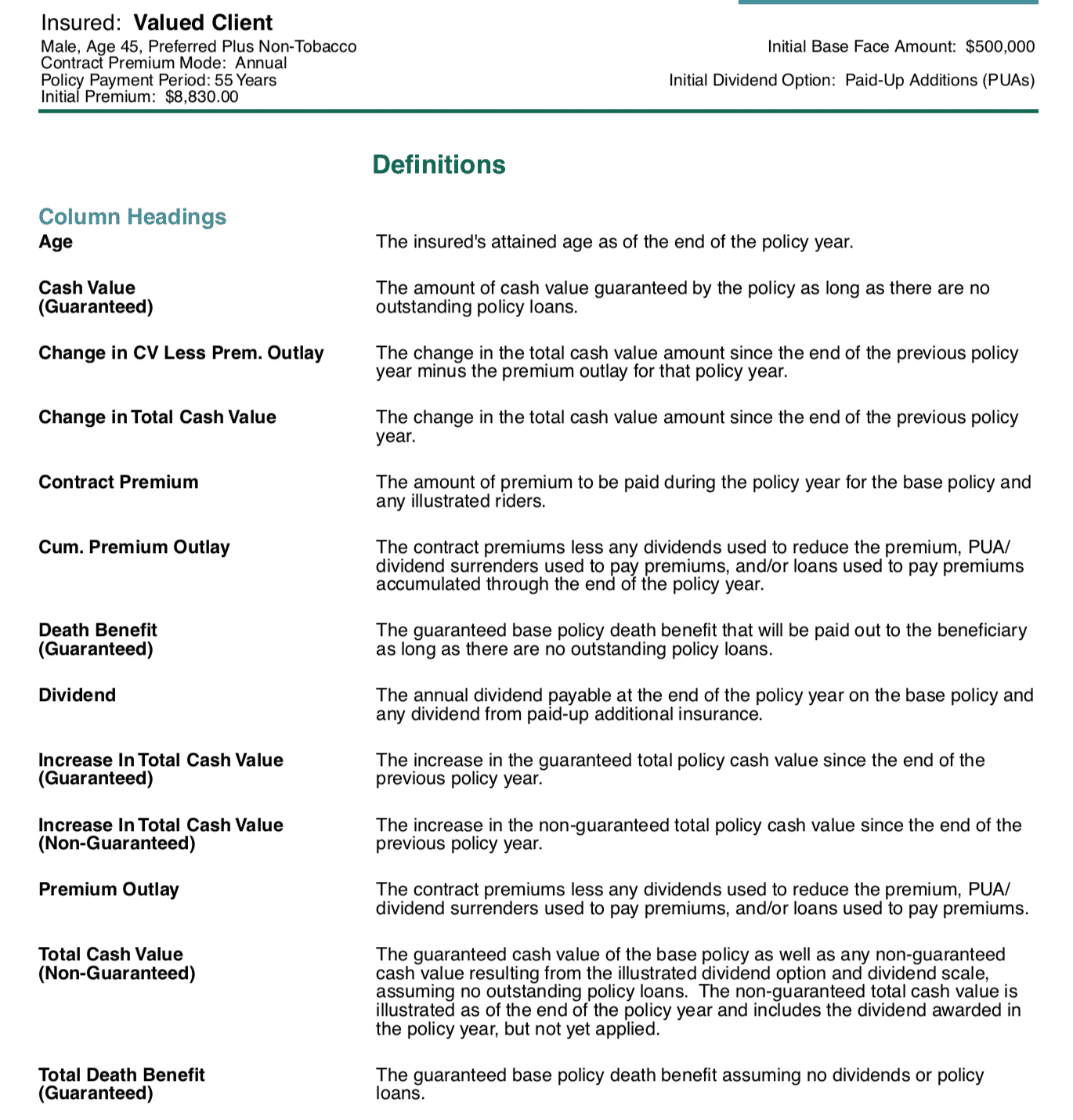

Not all whole life insurance illustrations will be alike. However, all of them will contain many standard key features that we will explain below.

Introduction & Summary of Coverage

The first part of any whole life insurance illustration is the company introduction. Within this section there is generally a brief introduction that discusses the life insurance company’s history.

After a brief company introduction, the illustration will provide a policy overview section or a summary that outlines the whole life insurance coverage.

This section provides a description of the key components included within the whole life insurance coverage. It can be best described as being similar to a terms and definitions page.

Cash Values

One primary benefit of a whole life insurance policy is the cash value feature. All participating whole insurance policies have a guaranteed cash value component, as well as a non-guarantee cash value component.

Both the guaranteed and non-guaranteed cash value components will show the annual cash value growth within the illustration separated into two columns.

The reason for a non-guaranteed cash value column lies within the potential dividend earnings. Since dividends are not guaranteed they are represented within the non-guaranteed cash value component.

Dividend amounts can also fluctuate so the non-guaranteed column should only be viewed as a potential possibility of future cash value earnings.

Projected Annual Dividend

In 2016, there were more than 290 million life insurance policies in force in the United States. Out of the 290 million life insurance policies in force, a large portion of those where whole life policies that paid a dividend.

Policies that pay a dividend are called participating. That name was given because the policyholder shares in the insurance company’s excess profit in the form of a dividend.

Within the whole life insurance illustration located on the non-guaranteed column, you will see the projected annual dividend. Again, it is important to understand that dividends are not a guarantee.

Death Benefit

Whole life insurance quotes can also include both a guaranteed death benefit and non-guaranteed death benefit.

In both cases, the death benefit is the amount the designated beneficiary will receive upon the insured’s death, provided the policy is in force.

The guaranteed death benefit is based on the amount of coverage requested and projected premium payments. Every policy has this kind of death benefit.

But some also have a non-guaranteed death benefit in the illustration. This is another projection that factors in the insurance company’s dividend scale along with the dividend option and coverage requested on your application.

Sample whole life insurance illustration showing both guaranteed and non-guaranteed cash values.

Sample of whole life insurance illustration showing definitions of terms within the illustration.

Your one-stop online guide for life insurance quotes. Get free quotes now!

Secured with SHA-256 Encryption

Why the Illustration Matters

Life insurance companies provide illustrations to help you see the potential long-term value and impact of your whole life insurance choices before you sign on the dotted line.

They’re a tool to help you be confident that you’re about to make the right choice for you and your loved ones.

But they aren’t the only things you need to understand about whole life insurance quotes.

Other Aspects of Whole Life Insurance Quotes

As we mentioned, there are many parts of a whole life insurance illustration that are based on projections.

But what about the absolutes of the whole life product you’re considering buying? Some parts of the quote you receive are fixed. You need to be aware of those too.

Participating or Non-Participating

As we outlined above when talking about dividends, there are participating and non-participating policies.

The quote should make it clear which type of whole life product is under consideration. If you’re comparing quotes from different companies, make sure you know if you’re comparing apples to apples.

- Non-Participating – Does not pay out a dividend

- Participating – Can pay out a possible dividend

Read more: Non-Participating vs. Dividend Paying Whole Life Insurance

Surrender Value and Conditions

Whole life insurance products come with a surrender value. That’s the amount you would receive if you cancel the policy early.

The surrender value is always zero until a specified number of years have passed with the policy in good standing. Generally, the longer you hold the policy, the higher the surrender value.

It’s uncommon to buy a whole life insurance product expecting to surrender it. But when comparing whole life insurance quotes, consider the impact of differing surrender values.

Riders

The quote you receive from the insurance company will spell out the riders should any have been chosen.

Riders are optional and additional conditions to the policy. Common riders include: disability and accidental death.

The type and number of riders added to a policy will affect the required premiums.

Many whole life insurance policy’s offer a free rider, such as living benefits, that can pay out an early benefit due to a qualifying illness. Within the illustration details to these rider will be provided.

Exclusions

Exclusions are provisions within an insurance policy that eliminate coverage for certain acts or conditions. For example, a life insurance policy could exclude extreme sports or pre-existing medical conditions.

Be sure to read and understand all exclusions. If comparing quotes, don’t assume the exclusions are the same for each company.

And, if it matters to your personal situation, exclusions can often be removed, but premiums will likely increase. For example, a race car driver would be wise to have an extreme sports exclusion removed in exchange for higher premiums. (For more information, read our “Extreme Sports Life Insurance Rates“).

How to Request Whole Life Insurance Quotes

Whether you’re still in the early stages of shopping for life insurance or even if you have a company or two in mind, then please feel free to reach out to us for a free quote.

Top Quote Life Insurance works with dozens of the top rated whole life insurance companies making it easy to get you both the best coverage at the best rates.

Read More About Whole Life Insurance:

Ready to Compare Life Insurance Rates?

It’s free, fast and super simple.

Looking to compare life insurance policies? We can help. Enter your ZIP code to get free quotes from multiple insurers.